What comes to your mind when you first think of retirement life? When communicating around I observed that many people think that one’s retirement life can be simply about surviving.

What I feel is that instead of simply surviving it can be about cherishing your yesterdays, fully living your today, and not worrying about your tomorrow. To do that, you will need adequate finances. Many of us would also presume that life in retirement will remain the same throughout, but that may not be the case.

What is Retirement?

Retirement is all about redesigning and rebuilding your lifestyle. During the first few years of your retirement life, your health will be supportive, you may be able to travel or work a part-time job to supplement your income. However, your finances also require a change in how they are allocated due to these changing lifestyles.

Let’s assume that Mr. Nirav retired at the age of 60 and has saved enough to fulfill his retirement needs. Mr. Nirav always wished to teach music, so he is considering a part-time job in that field. Although he lives with his wife and has no other responsibilities.

Mr. Nirav has a net worth of 2 crores. He has his own house, a life insurance policy and health insurance worth Rs. 5-7 lakhs. But the major concern is that the majority of his investments are in equity markets which is very risky considering his current scenario.

Mr. Nirav wants to diversify his current portfolio in a manner that is less risky, more liquid & generates a regular source of income.

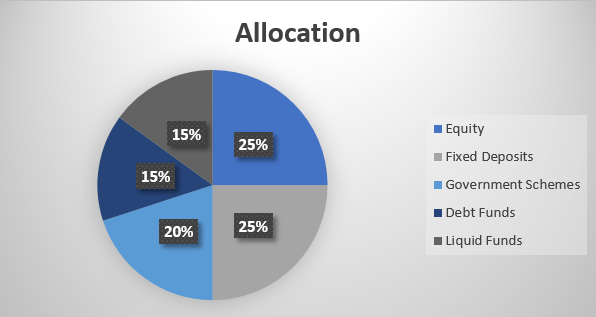

The allocation listed below can be suitable for him:

The above allocation is sustainable only if the condition of Mr. Nirav remains constant. Let us assume that, he turns 75 and his health turns extremely weak than what it used to be earlier. Also, due to his health issues, he had to quit his part-time job and cannot travel much either.

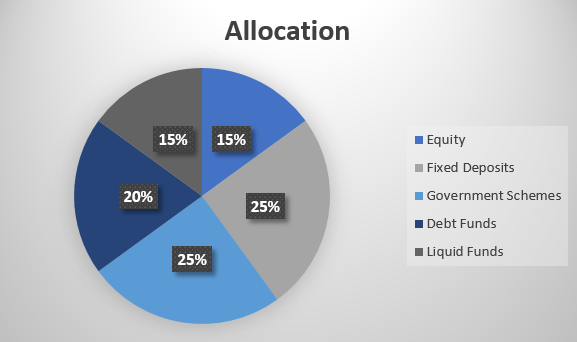

As a result, there will be a decrease in his travel expense but at the same time, his medical expense can increase. As a result, in these circumstances, he should reallocate his portfolio as follows:

The above-stated allocation can be appropriate as fixed deposits provide you with safety and security. Investing in government schemes can avail you with periodic withdrawals which can be considered income generation, and liquid funds maintain the level of liquidity.

In contrast, equity and debt can be return-generating tools. Also, with the deteriorating health medical security becomes necessary. Moreover, the funds generated from the above allocation will be sufficient to pay for your medical security such as health insurance premium.

Whilst also ensuring those financial components of your retirement, you will be able to live a confident and stress-free retirement.

This will guide you toward leading a contented and healthy life. So, when you put on your shoes and begin your retirement, be ready to unpack the upcoming adventures and don’t forget to appreciate the valuable resources that you will have.